Johns Hopkins University School of Medicine

Baltimore, MD

Program Director: Henry Fessler, MD

Program Associate Director: Mahendra Damarla, Meredith McCormack, Natalie West

Program Type: Pulmonary/Critical Care

Abstract Authors: Yuval Bar-Or PhD, Sammy Zakaria, MD, MPH, Henry Fessler, MD

Description of Fellowship Program: Our program's mission is to train the next generation of leaders in academic pulmonary and critical care, who will advance our field through scholarship in patient care, research and teaching. The mission is supported by strong, personal mentorship, a rich research environment, and clinical experience that is both broad and deep. Over the past decade, 95% of graduates have become full-time academic faculty, with a record of publication, successful funding, and clinical and research expertise.

Abstract

Background

Fellows bear substantial financial stress. They carry an average of nearly $200,000 of medical school debt, face impending career decisions with large financial implications, and are often starting families or purchasing their first home. However, they typically receive little instruction in personal finance through their residency or fellowship training programs, and what they receive is often delivered by financial planners who are marketing services or products. This can delay or impair important financial decisions, with long-term harm. 1. Teichman JM, Bernheim BD, et al. How do urology residents manage personal finances? Urology. 2001; 57:866–71. 2. Teichman JM, Cecconi PP, et al. How do residents manage personal finances? Am J of Surgery, 2005; 189:134-9. 3. Glaspy JN, Ma OJ, et al. Survey of emergency medicine resident debt status and financial planning preparedness. Acad Emerg Med. 2005;12:52–6. 4. Mizell JS, Berry KS, et al. Money matters: a resident curriculum for financial management. J of Surgical Research. 2014; 192: 348-55.

Methods

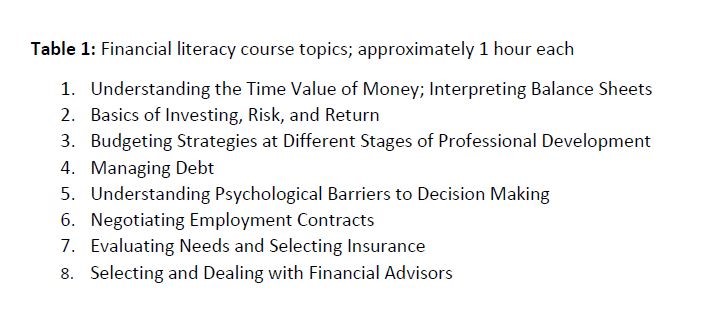

To meet this need, we collaborated with a faculty member in our business school with expertise in personal finance education (YB). Over four weeks, he delivered an 8-hour, in-person interactive course for fellows in PCCM, that had previously been piloted with another training program and revised with participant and the co-authors’ input. To share the cost of the course, which was paid by the participating programs, Cardiovascular Disease and Infectious Disease fellows were also invited. The curriculum topics are shown in Table 1. As a needs assessment, fellows who expressed interest in attending were asked to provide their demographics, household income, assets and debt. Following the course, attendees completed course evaluations and a survey asking what financial decisions they had made based upon it.

Results

The course was offered to 58 fellows in the three fellowships. Twenty-five expressed an intent to attend the course. Eighteen of those completed the pre-course survey. Two-thirds were female and two-thirds married, with a mean age of 32.7 years. All married fellows had working spouses. Eight respondents had 1-3 children. All but one owned or leased a car and half owned a home. Household debt ranged from $40,000 to >$200,000. Twelve fellows completed the post-course survey after attending an average of 70% of the sessions. All respondents strongly agreed or agreed that they learned from the course, that the material should be taught in GME programs, and that they would recommend the course to others. Eleven of the 12 respondents reported making a total of 21 concrete financial decisions as a result of the course, related to retirement planning and investment, insurance coverage, employment contracts and debt management.

Discussion

Previous studies, although few, have found that medical residents have high debt/income ratios, miniscule retirement savings, and lack household budgets (1-2). However, financial literacy training during residency or fellowship is scant (3-4). When provided, it is often by advisors with products or services to sell, which may bias their presentations. Our curriculum was unique in its depth and its leadership by a business school faculty member without potential biases or conflicts of interest. Despite busy schedules, more than a third of the invited fellows attended this eight-hour class. They perceived it as valuable, and it prompted tangible financial decisions. This model may be generalizable among programs at institutions with business schools or other local, unbiased experts. We believe that greater attention to fellows’ financial literacy will contribute to a heightened sense of control over their future and greater short- and long-term well-being. As these learning needs are shared by all trainees, we are currently exploring expanding this course to all GME trainees at our institution.

References

-

Teichman JM, Bernheim BD, et al. How do urology residents manage personal finances? Urology. 2001; 57:866–71.

-

Teichman JM, Cecconi PP, et al. How do residents manage personal finances? Am J of Surgery, 2005; 189:134-9.

-

Glaspy JN, Ma OJ, et al. Survey of emergency medicine resident debt status and financial planning preparedness. Acad Emerg Med. 2005;12:52–6.

-

Mizell JS, Berry KS, et al. Money matters: a resident curriculum for financial management. J of Surgical Research. 2014; 192: 348-55.